Trailer and Prime Mover Registration in Thailand 2016

Although Thailand’s GDP grew 3.2% in 2016, according to Bank of Thailand, this growth did not contribute to any expansion in the Trailer industry in Thailand. On the other hand, the logistics industry has continued to see more fierce competition from newer players from abroad who have had previous experience and connections working with multinationals. A stagnant 2016 for body makers of trucks and trailers could also have resulted from a decline in world economy especially in China and Europe where consumer spending and confidence have been nothing but fragile.

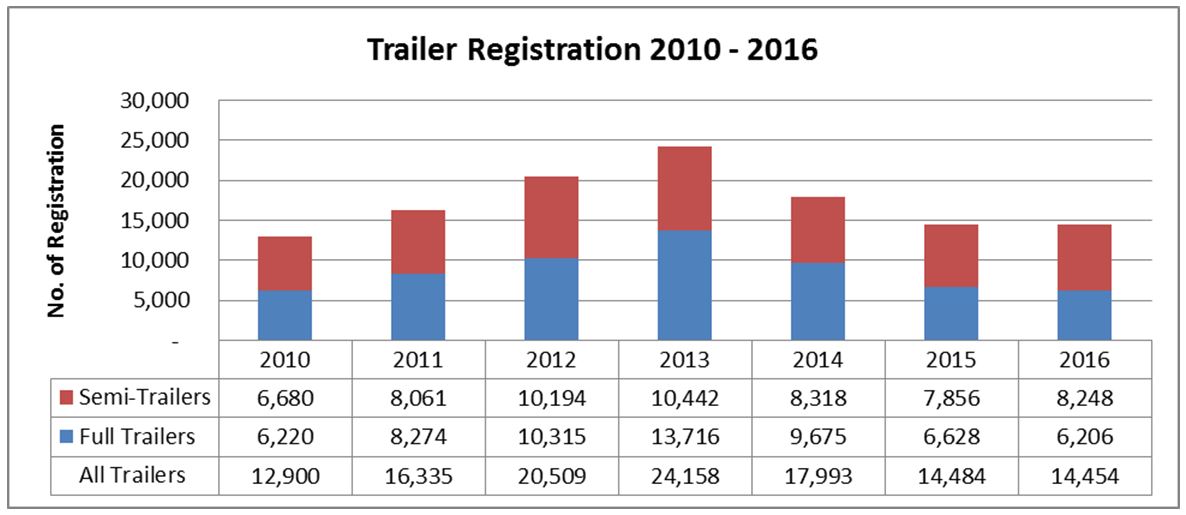

While total number of accumulative trailer registration by the end of 2016 has increased from 187,219 units to 189,139 units, a 2,100 or 1.1% increase, this is not a healthy growth. Total number of new trailer registration for 2016 vs 2015 has remained flat (see Figure 1.0) at 14,454 units compared to 2015’s at 14,484 units. Investigating deeper one can see that the number of semi-trailer registration has actually increased at about 5% while the number of full-trailer registration has decreased by about the same. Lower demand for agricultural usage resulting from the drought in early 2016 combined with a huge number of full-trailers from 2013 that are still currently in the market has probably contributed to the decline.

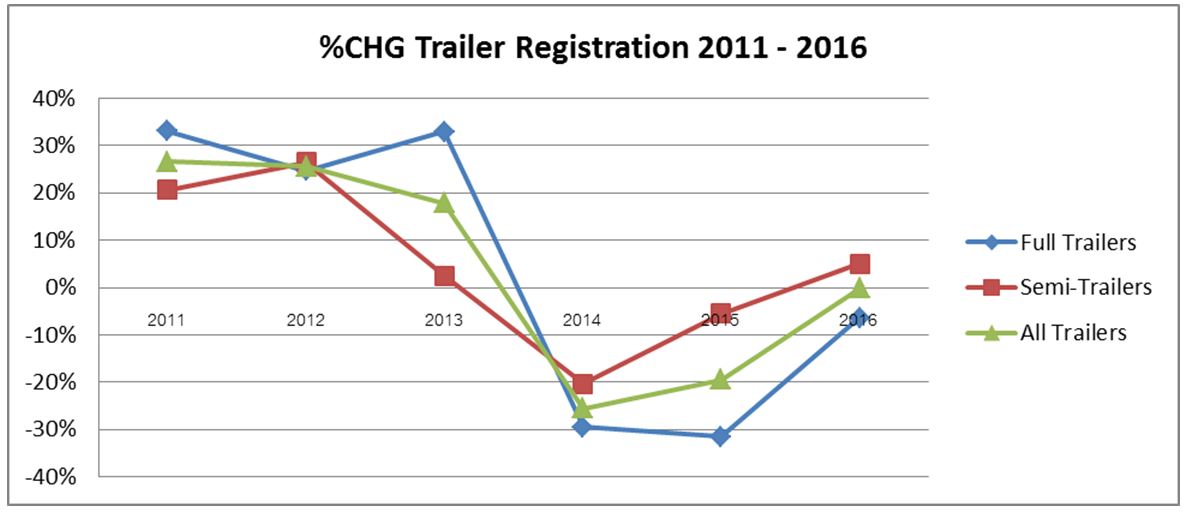

Figure 2.0 shows the percentage change in total trailer registration from 2010–2016.

Figure 1.0 Total number of trailer registration in 2010-2016

Figure 1.0 Total number of trailer registration in 2010-2016

Figure 2.0 % Change in total number of trailer registration 2011-2016

Figure 2.0 % Change in total number of trailer registration 2011-2016

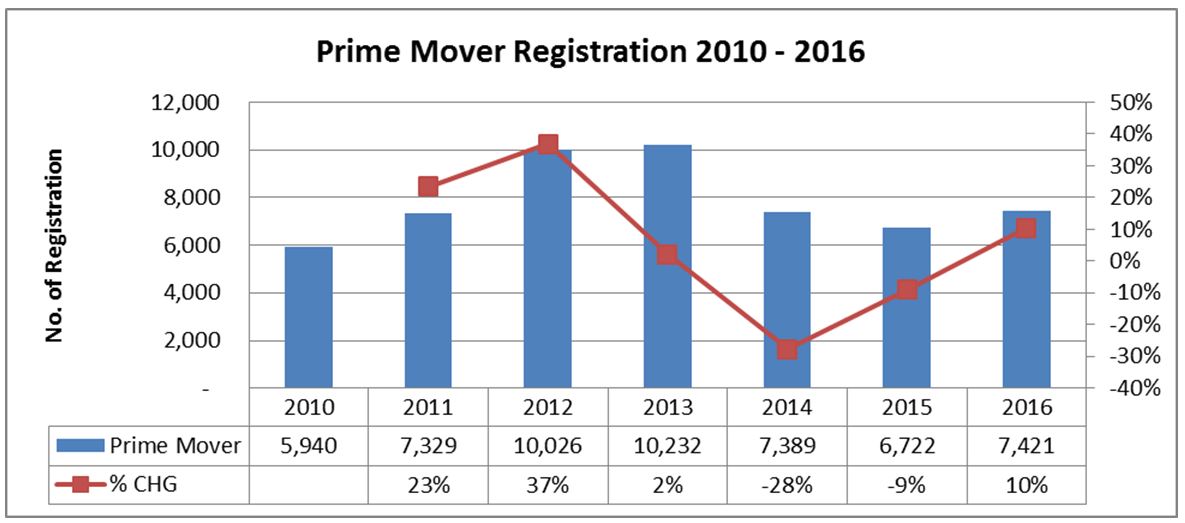

It’s somewhat slightly more positive for trucks and prime movers. The total number of prime mover registration for 2016 was at 7,421 units, roughly 10% growth compared to 2015 figures (see Figure 3.0). Although prime movers have a relatively shorter life cycle than trailers, this could mean that logistics providers are preparing their fleet for prospect projects in 2017.

Figure 3.0 Prime mover registration 2010–2016

Figure 3.0 Prime mover registration 2010–2016

Although it is pretty certain that 2017 will not be the year that we will witness another peak like 2013, market performance of the first two months cannot yet tell whether 2017 will be another great year for body builders. We suspect though that the market will face a low single digit growth, driven by increased consumption in the region and that the rate of growth of semi-trailer registration will continue to outgrow that of full trailers.

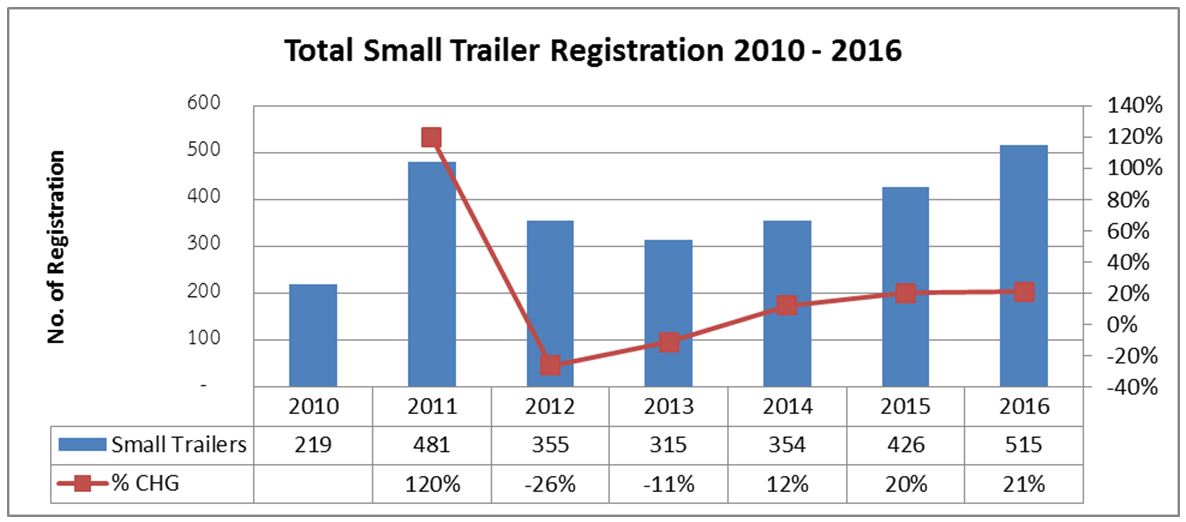

Another potential market worth watching is the small trailer market. These trailers are not registered under the Logistics Legislation but under the Passenger Car Legislation sub-heading 16. Although these trailers may be very common overseas but the numbers for Thailand is still minuscule. Growth is on the horizon as Thailand becomes more strict with gross vehicle weight – pick-up users are incentivized to use small trailers as they need to carry more load per trip to save on fuel costs.

In 2016, the number of small trailer registration was at 515 units, a 21% increase from 2015 (Figure 4.0). As of 31 December 2016, the number of accumulative registration for small trailers is at 3,958 units.

Figure 4.0 Number of Small Trailer Registration 2010 – 2016

Figure 4.0 Number of Small Trailer Registration 2010 – 2016

Source : Ministry of Transport, Thailand

Updated : February 2017